Compare Builders Merchants Insurance

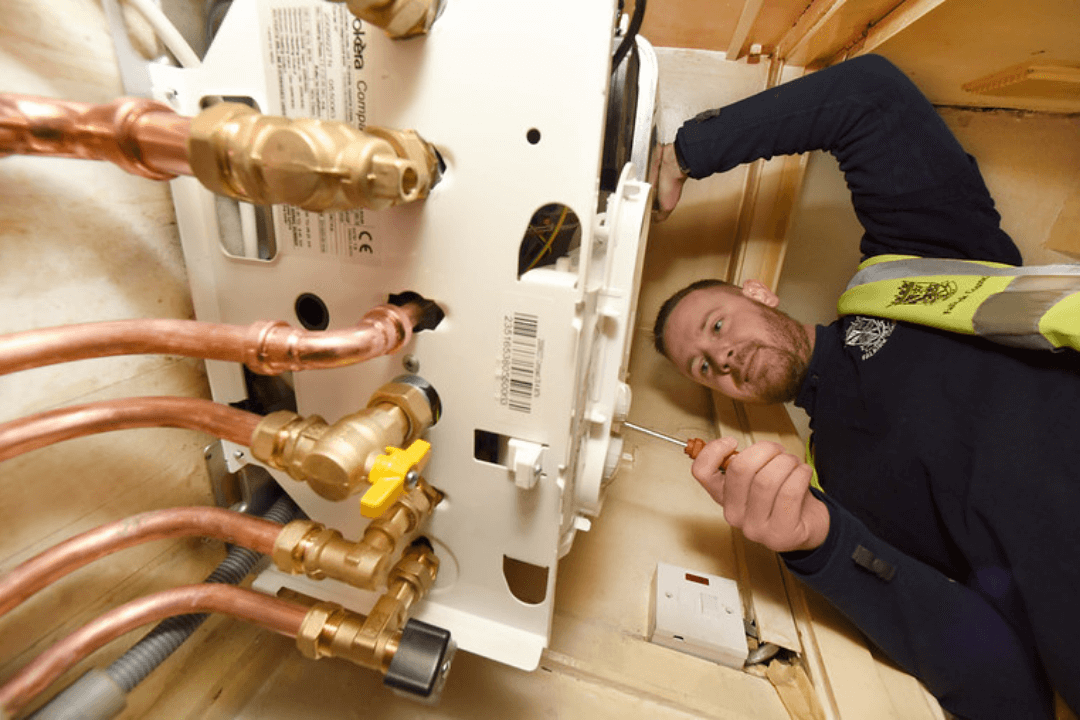

As a builder’s merchant, your company is situated at the heart of the construction trade. You work to provide a wide range of products while you keep a large amount of stock on hand. For this reason, you face many risks each day. These can include poorly managed stock, forklift accidents, as well as storing harmful chemicals and flammable products. For these and other reasons, you should consider purchasing builders merchants’ insurance.

Who Needs Builders Merchants Insurance?

Builders’ merchant’s insurance is generally a good choice for anyone trading in building supplies and related products.

A bespoke insurance policy is the best option in order to fully protect your business.

Save yourself time and money. Compare Builders Merchants Insurance today

Builders Merchants Insurance FAQs

Who Needs Builders Merchants Insurance?

Builders’ merchant’s insurance is generally a good choice for anyone trading in building supplies and related products. A bespoke insurance policy is the best option in order to fully protect your business.

What Types of Builders Merchants Insurance Do I Need?

There are several types of policies you may want to consider, depending on your business needs.

1). Public Liability Insurance

Public liability insurance protects you against claims from third parties who may be injured or whose property is damaged in the course of your work. Public liability insurance generally covers the following:

- Accidents when working on the premises, on a commercial or residential building site.

- Accidents when building new structures, altering, converting, or extending an existing building.

- Accidents that happen due to your work, faulty materials, equipment, or parts

With public liability insurance, you’ll have peace of mind that your business is protected even when things go wrong. You’ll have the financial protection to ensure your builder merchant business can keep running in spite of claims and legal fees.

2). Employer’s Liability Insurance

Employer’s liability insurance covers you when an employee becomes sick, is injured, or dies while on the job. This type of coverage generally protects you against:

- Employee illness and injury

- Medical bills and legal fees

If you have one or more employees, then you’re legally required to have employer’s liability insurance coverage.

3). Tools Insurance

What would happen if your tools were lost, damaged, or stolen? Your tools are the heart of your business and replacing them would be a large expense for the business. This type of coverage will protect your tools from:

- Loss

- Damage

- Theft

However, you may need extra coverage for tools left in a van, hired plant, machinery, stock, or contents.

4). Stock Insurance

Stock insurance covers the materials your business is responsible for, such as bricks. This type of coverage will protect materials against:

- Loss

- Damage

- Theft

5). Professional Indemnity Insurance

Professional indemnity insurance protects you against a client who loses money due to your advice, designs, or services. This type of policy protects you against the legal costs involved in these situations.

We understand that it’s a challenge to take time and search for the right insurance provider. That’s why we built this site—to make the process easier and faster. What’s more, when you use our insurance comparison tool, you’ll receive quotes from providers within a few moments!

Once you’ve received the results, you can take your time to review each policy, making the process faster and smoother than searching on the Internet.

If you have questions about how to use our site or about specific types of builder’s merchants’ policies, reach out and contact us today! We’re looking forward to talking with you!

Do I Need Employer’s Liability Insurance for One Employee?

What if I Have No Employees? Do I Still Need Employer’s Liability Insurance?

I’m Self-Employed, Do I Need Employer’s Liability Insurance?

Do I Need Employer’s Liability Insurance for a Limited Company?

Do I Need Insurance for Temporary Workers?

Do I Need Employer’s Insurance for Subcontractors?

What our customers say about us

Our support does not end with the purchase of your cover. We are here to support you when you need us.

If you have questions or would like to update, or renew your policy, all you have to do is contact us. We will also help if you need to make a claim.

Jason Mitchell

Very easy & uncomplicated online comparison, easy & very competitive prices for fully comprehensive insurance for our gas business, very fast delivery of email confirmation of your policy, very efficient indeed you must try these for a smooth, quote and buy transaction, no more being bombarded with telephone calls from brokers.

Andy Harrow MD

Easy and simple form to complete, step by step, then gave me a number quotes from a number of insurers, then allowed me to purchased there and then, covered and an email sent straight away with my policy documents, Thanks again, highly recommended. Andy

Marshall & Sons

My renewal was due to expired so I used Mybusinesscomparison's quote and buy service. This made the whole process painless.

I recommend this company for quality service and confidence you are properly insured.