Compare Gas Fitters Insurance

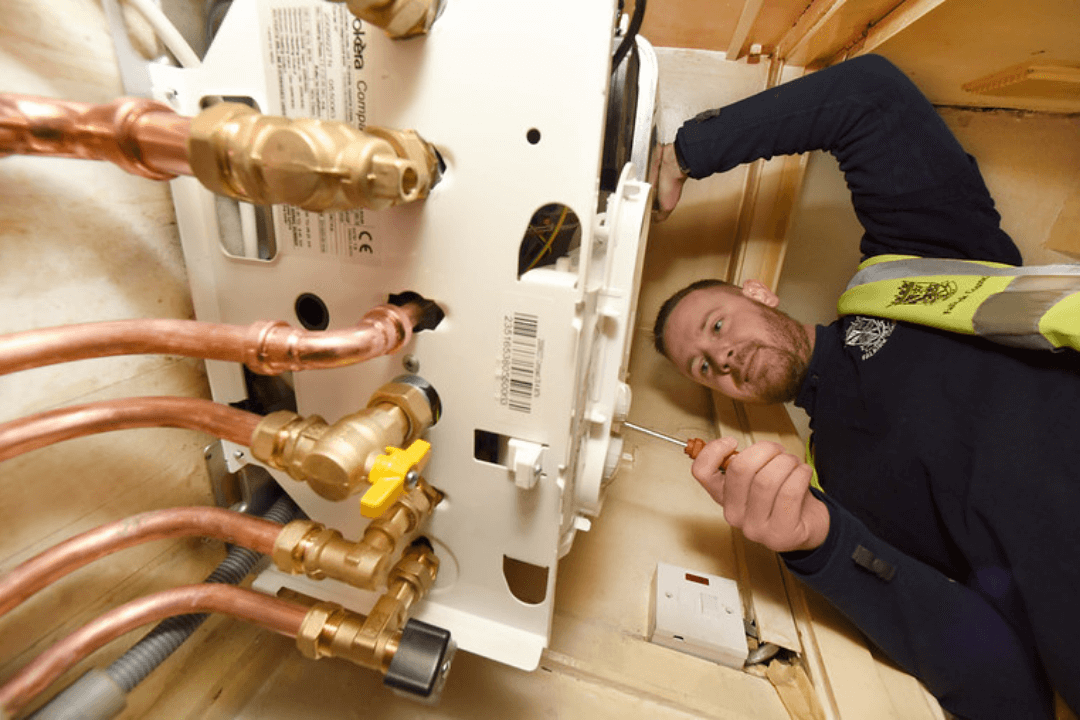

As a gas fitter, you work with high-risk issues and complex systems. In addition, your clients want to be reassured that you’re protecting them against any problem that may come up on the job. These issues can include fire and flood damage, and other problems.

What Types of Coverage Does a Gas Fitter Need?

There are a wide variety of insurance policies that could be a benefit to your company. However, there are a couple you should consider:

Public liability insurance: this type of coverage protects you and your business in case your work leads to a client’s or a third party’s property becoming damaged or if the client or a third party are injured.

Employer’s liability insurance: if you have one or more employees, then you’re legally required to have this type of coverage. It protects employees and anyone working for you in case they become ill or injured on the job.

Why should I consider Gas fitters insurance?

Consider what could happen if your work causes a fire in a residence. This would result in an expensive claim. And if the home was occupied by residents or if third parties were walking by the home at the time of the fire, they could also be injured. Think of the huge claim that could result from the incident. Are you and your business prepared to take on such a large expense?

Remember that these types of claims can be expensive; in fact, they could be large enough to put you and your business in financial peril. They can even cause your business to be closed permanently. It’s important to protect you, your business, clients, and third parties from the risks your services may cause.

Save yourself time and money. Compare Gas Fitters Insurance today

Gas Fitters Insurance FAQs

Why Do I Need Gas Fitters Insurance?

This is because of the risks you and your business face while on the job each day. Claims can be very expensive. They may be so high that you and your business are put at financial risk, and/or your company could even be closed if it’s not able to pay a claim.

Do I Need Employer’s Liability Insurance for One Employee?

Yes, you’re legally required to have this type of coverage for one or more employees. The minimum level of coverage you require is set at £5 million.

I Have No Employees, Do I Need Employer’s Liability Coverage?

If you don’t have employees or workers, then you probably won’t need this type of policy. However, if you have subcontractors, hire voluntary or casual workers then you should consider buying employer’s liability insurance.

If I’m Self-Employed, Do I Need Employer’s Liability Insurance?

If you’re self-employed and have no employees or workers, then you may not need employer’s liability insurance. However, you may need this type of coverage if a client requires you have to this type of coverage to work on a specific project.

Do I Need Employer’s Liability Insurance for Volunteers?

This is not a legal requirement; however, you may want to have this type of coverage for volunteers. This is because they could be injured while working for you, which means they could press a claim against you and your company in case of an injury or becoming ill on the job.

What our customers say about us

Our support does not end with the purchase of your cover. We are here to support you when you need us.

If you have questions or would like to update, or renew your policy, all you have to do is contact us. We will also help if you need to make a claim.

Jason Mitchell

Very easy & uncomplicated online comparison, easy & very competitive prices for fully comprehensive insurance for our gas business, very fast delivery of email confirmation of your policy, very efficient indeed you must try these for a smooth, quote and buy transaction, no more being bombarded with telephone calls from brokers.

Andy Harrow MD

Easy and simple form to complete, step by step, then gave me a number quotes from a number of insurers, then allowed me to purchased there and then, covered and an email sent straight away with my policy documents, Thanks again, highly recommended. Andy

Marshall & Sons

My renewal was due to expired so I used Mybusinesscomparison's quote and buy service. This made the whole process painless.

I recommend this company for quality service and confidence you are properly insured.