Compare Professional Indemnity Insurance

If your business works on a contractual basis with clients, professional indemnity is a must. It’s designed to protect you against claims made by your clients for any financial loss that arises from negligence in your professional advice or services. Superscript’s cover also includes media liability as standard, to cover claims in relation to accidental copyright infringement.

Getting the right Employer Liability cover

Most employers are required to have a minimum of £5 million of employer’s liability insurance. This is the minimum legal requirement; however, there may be certain exemptions for your business. Exemptions can include public organisation and businesses that employ only family.

We’ve worked to find partners that offer employer’s liability insurance, along with any other business insurance coverage you may need.

Finding competitive Employer Liability insurance

We’re here to help you find the best competitive quotes for your employer liability insurance.

To assist you, we may require a few details about your business such as the type of business you own, and how long you’ve been in business. While there is a wide range of cover levels, we’re here to help you find the best quote for your company’s employer liability insurance insurance. We’ll find a quote that’s easy on your budget, without sacrificing quality, coverage, or services.

Save yourself time and money. Compare Professional Indemnity insurance today

Professional Indemnity Insurance FAQs

Do I Need Employer’s Liability Insurance for One Employee?

What if I Have No Employees? Do I Still Need Employer’s Liability Insurance?

I’m Self-Employed, Do I Need Employer’s Liability Insurance?

Do I Need Employer’s Liability Insurance for a Limited Company?

Do I Need Insurance for Temporary Workers?

Do I Need Employer’s Insurance for Subcontractors?

Do I Need Employer’s Liability Insurance for Volunteers?

Do I Need Employer’s Liability Insurance for Students on Work Experience?

What our customers say about us

Our support does not end with the purchase of your cover. We are here to support you when you need us.

If you have questions or would like to update, or renew your policy, all you have to do is contact us. We will also help if you need to make a claim.

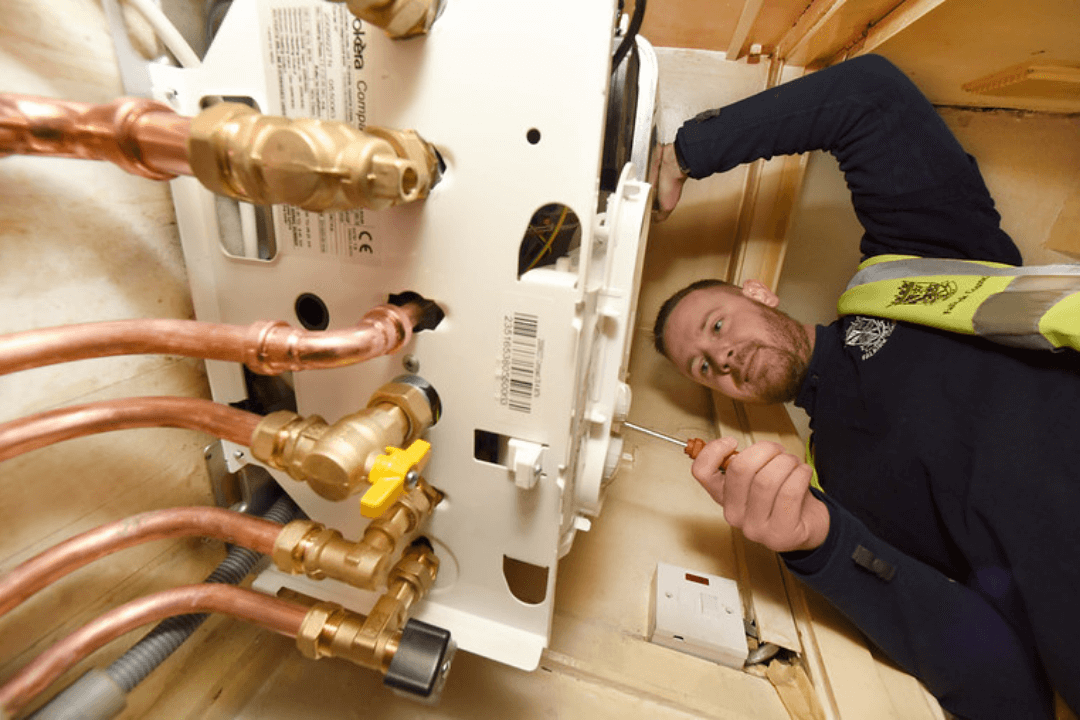

Jason Mitchell

Very easy & uncomplicated online comparison, easy & very competitive prices for fully comprehensive insurance for our gas business, very fast delivery of email confirmation of your policy, very efficient indeed you must try these for a smooth, quote and buy transaction, no more being bombarded with telephone calls from brokers.

Andy Harrow MD

Easy and simple form to complete, step by step, then gave me a number quotes from a number of insurers, then allowed me to purchased there and then, covered and an email sent straight away with my policy documents, Thanks again, highly recommended. Andy

Marshall & Sons

My renewal was due to expired so I used Mybusinesscomparison's quote and buy service. This made the whole process painless.

I recommend this company for quality service and confidence you are properly insured.