Compare Haulier Insurance

Are you a haulage contractor or the owner of a haulage business? Then you’ve come to the right place! We offer haulier insurance policies, which can be tailored to meet the needs of your unique business.

What Does Haulier Liability Insurance Cover?

This is a goods in transit insurance, which provides for loss and damage to the goods in your care, custody, and control. It’s important to look for a policy that provides adequate coverage.

When searching for the right policy, always read through the policy documents thoroughly. This is because some insurance providers may use wording that is misleading, meaning you may not receive the specific coverage you need. In addition, the provider’s policies may include conditions about unattended vehicles, security requirements, and more. It pays to read each policy through from beginning to end. This way, you’ll know exactly what’s covered or not.

As you read through each policy, it’s helpful to make notes and write down questions on those parts that are confusing. Then you can reach out to the specific provider for help or contact us. We’re here to help you find the right insurance for your haulier business.

Why Does a Haulier Need Liability Insurance?

You face a wide range of risks as a haulier. Legal action can be taken against you for personal injury, property damage, and more.

The resulting claims can be extremely expensive when it comes to compensation and legal costs.

This is where haulier liability insurance comes into play. It protects you against claims and legal fees that may result from accidents of all types.

Save yourself time and money. Compare Haulier Insurance today

Haulier Insurance FAQs

Do I Need Employer’s Liability Insurance for One Employee?

What if I Have No Employees? Do I Still Need Employer’s Liability Insurance?

I’m Self-Employed, Do I Need Employer’s Liability Insurance?

What Type of Haulier Liability Insurance Do I Need?

That will depend on the unique aspects of your business; however, in general, a haulier may be interested in the following types of haulier’s insurance.

1). Public Liability

Public liability insurance protects you against claims that may arise from the injury to third parties or damage to their property. This type of coverage can also provide protection against claims that come from the sale or supply of a product.

You’re not legally required to have public liability coverage; however, keep in mind that accidents happen. When an accident does happen, you and your company will be protected with public liability insurance.

While you’re not legally required to have this coverage, it may be required under contract when working with clients.

2). Employer’s Liability Insurance

Employer’s liability insurance protects you against claims filed by employees who become injured, sick, or die as a result of working for you. Plus, if you have one or more employees, you’re legally required to have this coverage.

3). Professional Indemnity Insurance

Professional indemnity insurance protects you from claims made for losses due to professional services provided. It also protects you against claims arising from advice given to a client that causes them a financial loss.

As you can see, haulier’s insurance is an important financial investment, which works to protect you and your company from expensive claims and legal expenses.

If you have questions or need additional information, be sure to reach out and contact us today! We’re looking forward to working with you!

What our customers say about us

Our support does not end with the purchase of your cover. We are here to support you when you need us.

If you have questions or would like to update, or renew your policy, all you have to do is contact us. We will also help if you need to make a claim.

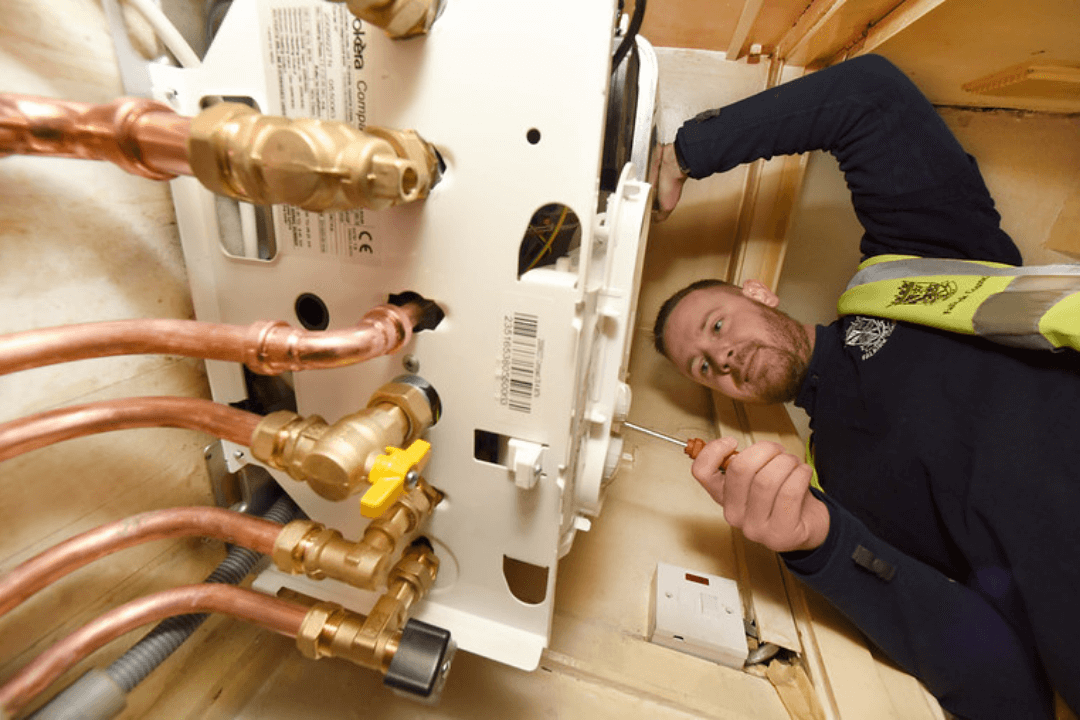

Jason Mitchell

Very easy & uncomplicated online comparison, easy & very competitive prices for fully comprehensive insurance for our gas business, very fast delivery of email confirmation of your policy, very efficient indeed you must try these for a smooth, quote and buy transaction, no more being bombarded with telephone calls from brokers.

Andy Harrow MD

Easy and simple form to complete, step by step, then gave me a number quotes from a number of insurers, then allowed me to purchased there and then, covered and an email sent straight away with my policy documents, Thanks again, highly recommended. Andy

Marshall & Sons

My renewal was due to expired so I used Mybusinesscomparison's quote and buy service. This made the whole process painless.

I recommend this company for quality service and confidence you are properly insured.